Series I of III

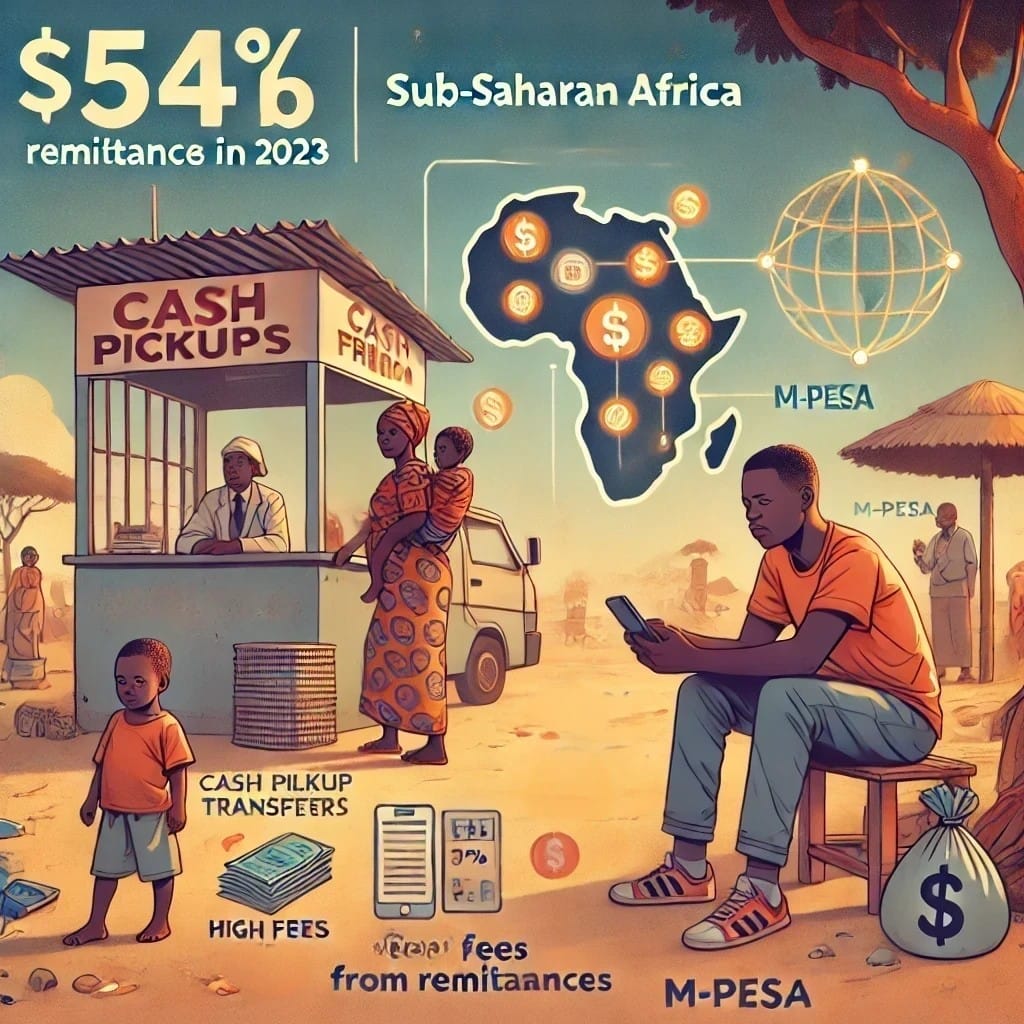

In 2023, Sub-Saharan Africa received $54 billion in remittances, surpassing foreign direct investment in the region. In countries like The Gambia, remittances account for over 26% of GDP. However, the reliance on cash-based transfers imposes significant costs.

Cash pickups, prevalent in rural areas, can incur transaction fees up to 13%, with recipients often traveling long distances and facing additional informal charges, leading to losses nearing 20% of the sent amount.

Digital solutions like mobile money platforms offer a more efficient alternative. Kenya's M-Pesa, for instance, has enabled over 90% of its population to conduct financial transactions digitally. Yet, adoption remains uneven across the continent due to infrastructural, educational, and regulatory challenges.

To maximize the impact of remittances, there's a pressing need to transition from cash to digital platforms, ensuring more funds reach recipients who need the money efficiently and securely.

Tags: #Africa Economy #Remittances #Digital Finance #Financial Inclusion #Mobile Money

Wendy Huffman is the Editor of the WBN News Nashville Edition & Founder & Owner of The Brilliant Edge Agency, delivering premier executive search and staffing solutions to help businesses secure top talent using the DREAM™ process. She is also the founder and CEO of the international nonprofit working in Africa, Letsmakethedifference.org, based in Nashville.

Connect with Wendy on Linkedin.com/in/wendyhuffman